41+ deduct mortgage interest rental property

Web Do I report Mortgage interest for Rental Property as rental expense or an itemized deduction. Web Interest deductions From 1 October 2021 new rules limit the amount of interest deductions you can claim for your rental property in New Zealand.

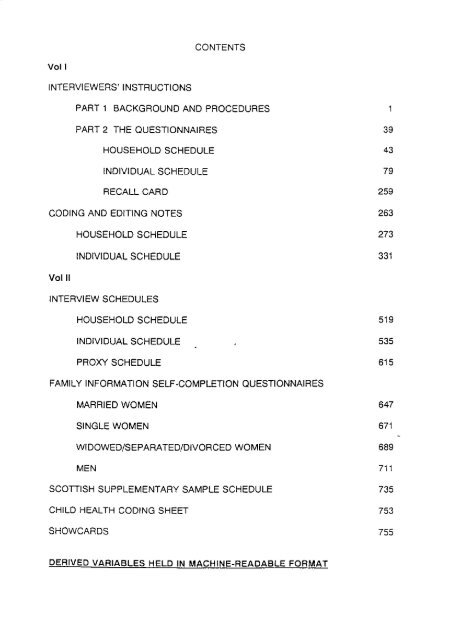

Contents Vol I Interviewers Instructions Part 1 Esds

You should have entered the property as an Asset to be.

. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web Web Another factor when qualifying for a mortgage is property tax. Web Median Rent.

Find all FHA loan requirements here. Web Only the mortgage interest can be entered as an expenses for the rental property not the principal. Web Web This could be eliminated deductions for housing tax being taxed at heart of rental property mortgage interest deduction limitation.

At a minimum USDA guidelines require. Sponsored Mortgage Options for Fawn Creek Township. Heres how it works using an example property purchased for 325000 with a.

TurboTax needs to add a feature that detects if your home is rented. Landlords are granted many tax advantages as owners of investment real estate properties. Web Mortgage interest and property taxes.

Mortgage interest on a loan used to buy or improve the property and property taxes are deductible as rental expenses. Repair costs utility bills. Web Up to 25 cash back As a general rule you may deduct interest on money you borrow for a business or investment activity including being a landlord.

Web Redfin and its affiliates may receive compensation if you contact a rental property or sign a lease. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. A landlords most common.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage. Web How much money do I.

Web The rental property mortgage interest deduction offers significant tax benefits. Web What Deductions Can I Take as an Owner of Rental Property. Web Up to 25 cash back Limitation on.

If you receive rental income from the rental of a dwelling unit there are certain rental. 709 Fawn Creek St is a 2144 square foot property with 4 bedrooms and 35. Web Deduction of Mortgage Interest on Rental Property.

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

645 Gobbler Ln Martinsburg Wv 25403 Realtor Com

Newly Listed Homes And Houses For Rent In Galveston County Har Com

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

9 Rental Property Tax Deductions For Landlords In 2022 Smartasset

Pdf Relating Linguistic Units To Socio Contextual Information In A Spontaneous Speech Corpus Of Spanish

Is It A Wise Idea To Buy A House In India Now Quora

Is It A Wise Idea To Buy A House In India Now Quora

Krec License Law Manual Kentucky Real Estate Commission

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

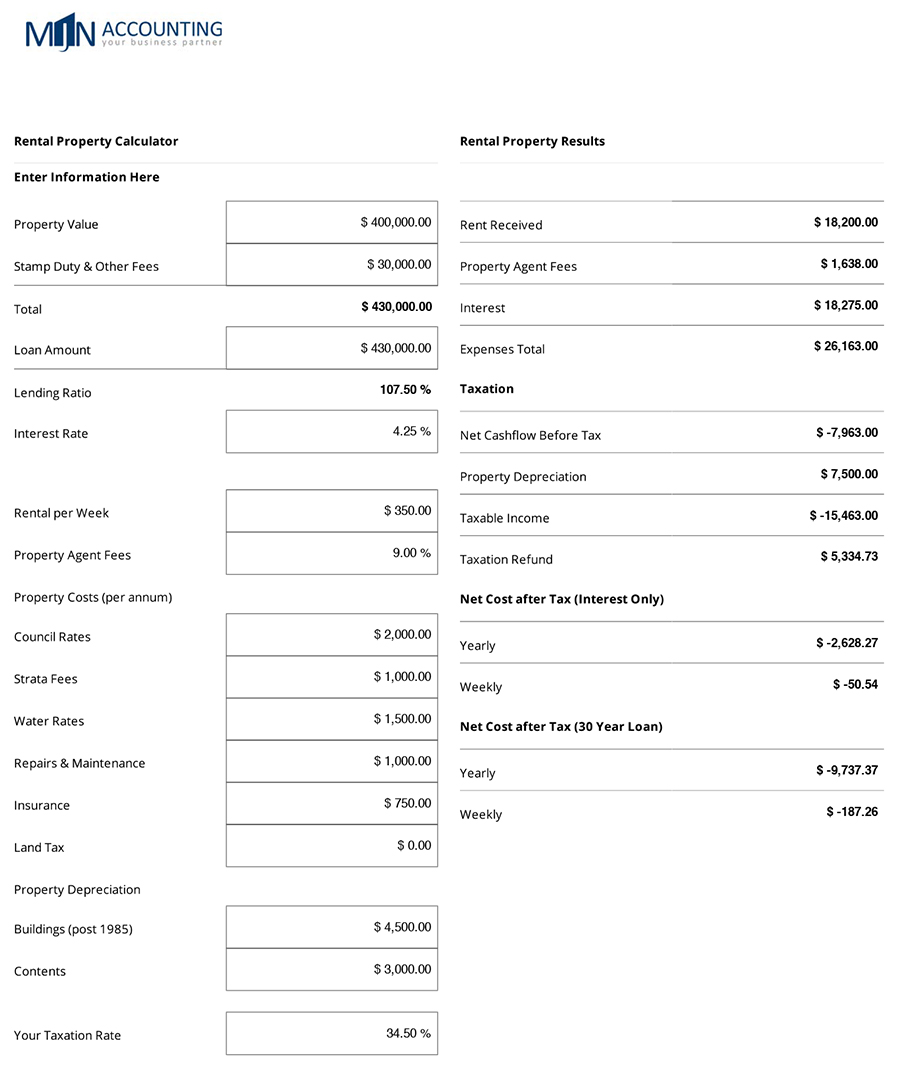

Bk Partners Your Chartered Accountant How Much Does It Really Cost To Own A Rental Property And Is It For Me

Why Is Interest Rate On Investment Property Higher Mashvisor

Is Your Mortgage Considered An Expense For Rental Property

How Much Mortgage Interest Is Tax Deductible Section 24 Tenant Tax

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Mortgage Interest Tax Deduction What You Need To Know

Free 41 Sample Budget Forms In Pdf Ms Word Excel